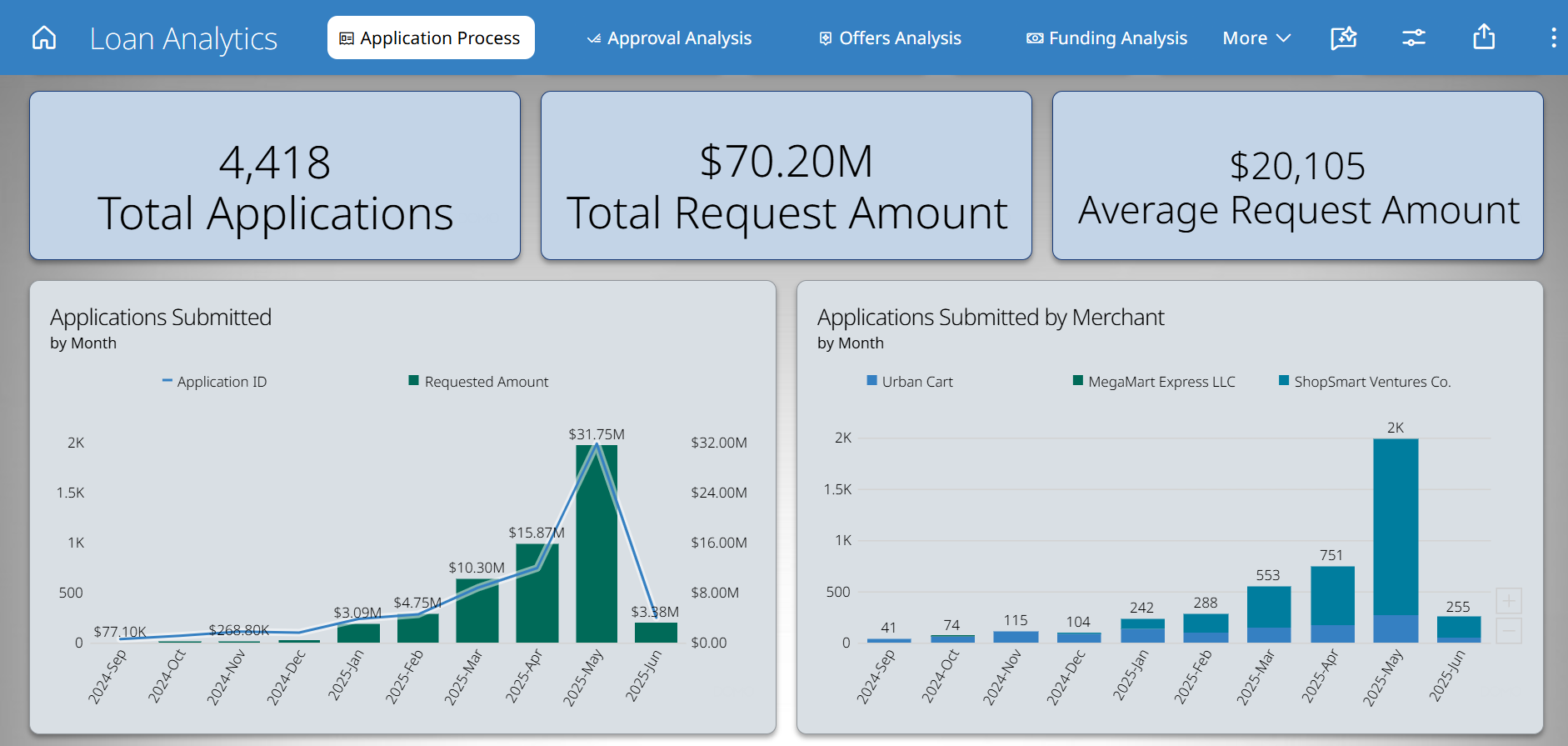

Easily track loan applications, approvals, funding, and merchant performance to accelerate decisions, improve efficiency, reduce risk, and optimize portfolio outcomes.

Managing large volumes of loan applications across multiple channels demands precise visibility into application trends, approval rates, funding activity, and merchant performance. Our Loan Analytics Dashboard delivers a unified view of your lending lifecycle—from submission to funding—empowering financial institutions to accelerate decision-making, improve approval efficiency, and minimize risk.

Comprehensive loan analytics to monitor performance, streamline approvals, and enhance lending strategies across channels and customer segments.

Track total applications, requested amounts, and average loan values - segmented by merchant, product type, geography, or channel.

Monitor auto vs. manual approval trends, pre-approval drop-offs, decline reasons, and monthly approval rates for operational benchmarking.

Understand which plans (Standard, Buy Down, Zero Interest) are most preferred, along with average term length and interest rate trends.

Visualize funded amounts, ready-to-fund pipelines, and merchant-specific funding performance by month.

Evaluate loan submissions, approval ratios, average FICO scores, and funding conversion by each merchant partner.

Monitor applications, approvals, funding, rates, and defaults to optimize lending performance.

Application Process

Approval analysis

Offers Analysis

Funding Analysis

Merchant Analysis